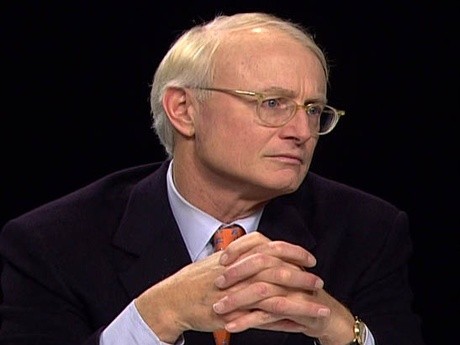

Monitor Group, founded by Harvard’s Michael Porter, files for bankruptcy and plans merger

Monitor Group, a Cambridge consulting firm founded by Harvard Business School professor Michael E. Porter that rose to prominence in the 1980s, filed for bankruptcy protection Wednesday as part of a deal to be acquired by Deloitte Consulting.

Monitor was involved in a controversy last year over the revelation it was paid $3 million a year from 2006 to 2008 to help improve the image of now-deceased Libyan dictator Moammar Khadafy. The firm apologized for the arrangement in 2011, calling it a “major mistake.”

In its Chapter 11 filing, in federal Bankruptcy Court in Delaware, Monitor listed assets and liabilities of between $100 million and $500 million. It reported having between 1,000 and 5,000 creditors, including RBS Citizens Bank, Standard & Poor’s Capital IQ, and various real estate, consulting, and audit firms.

Under the asset purchase agreement, New York-based Deloitte, a major US professional services firm, will take over Monitor’s US practice. Foreign arms of Deloitte will pick up Monitor’s overseas operations, which include offices from Brazil to Saudi Arabia.

Monitor said it has 1,200 employees in 26 offices. Eamonn Kelly, a spokesman for the company, said it expects “most employees” to be offered jobs with Deloitte, and for the Monitor brand to continue. Deloitte did not return calls seeking comment.

Kelly said the Khadafy ordeal was unrelated to the firm’s troubles. “We were facing increasing financial pressure as a stand-alone business,” he said. “The recent economic downturn drove us to evaluate our strategic options.”

Founded in 1983 by Porter and a group of Harvard-linked entrepreneurs, Monitor has specialized in strategy consulting to senior officials of businesses and governments. Porter, who still has a stake in the firm, was unavailable for comment. He has been less involved with the firm in recent years, though just last month he spoke on health care reform for Monitor at a New York event.

In a statement, Michael Canning, a national managing director of Deloitte, said, “We have long admired Monitor for its excellence in strategy consulting and we are excited about the fit and compatibility of our practices.”

Bansi Nagji, president of Monitor, attempted to downplay the dramatic reversal of fortunes for a company that once competed with the likes of big-name consultants such as Bain & Co. and Boston Consulting Group. He called the acquisition by Deloitte “hugely motivating.”

競爭力大師麥可波特 傳公司聲請破產

國際聞名的競爭力策略大師麥可‧波特(Michael Porter)創辦的管理顧問公司摩立特集團(Monitor Group),日前驚傳破產。

波特32歲便獲得哈佛大學商學院終身教授頭銜,是全球公認的競爭力策略權威。1983年,波特和一群與哈佛大學有關的企業人士創立摩立特集團,專門為企業主管和各國政府提供策略性的顧問諮詢服務,曾與貝恩資本、波士頓顧問集團並稱全球三大諮詢公司。

波特的演說收費相當高昂,過去一次演講門票高達8000元新台幣,儘管收費高昂,慕名而來的聽眾仍是絡繹不絕。

不過波特的高知名度仍敵不過大環境不景氣。根據《富比世》雜誌報導,由於全球經濟不景氣,使得企業諮詢業務大幅減少,導致摩立特集團在2008年便出現財 務危機,2009年公司的合夥人還需對公司再注資450萬美元,並停領2000萬美元的股利;摩立特之後還向私募基金Caltius資本管理公司借款 5100萬美元。

儘管如此,摩立特集團還是因為付不起利息與房租,於今年11月7日向法院宣告破產,公司將由紐約德勤管理顧問公司收購。

摩立特集團2006至2008年還曾因收受利比亞獨裁領導人格達費300萬美元,以協助提升其國際形象,去(2011)年格達費垮台後,該公司也因為這項業務而遭到質疑,公司還為此事道歉。

沒有留言:

張貼留言