McDonald’s is having a moment.

McDonald’s is having a moment.

Actually, it’s been having one for a while. Analysts may find no shortage of things to fret about -- from rising labor costs to lousy consumer feedback on the quality of the food -- but investors love McDonald’s Corp. Okay, there was that seven-quarter U.S. sales slump that took the blush off the share price. It ended last year, though, after Steve Easterbrook became chief executive officer, and overall the stock has climbed 267 percent in the past decade. (It’s up more than 30 percent in the last 12 months alone.)

“McDonald’s has its challenges, but they’re resilient,” said Bob Goldin, vice chairman at industry researcher Technomic Inc. Even he, a fan of sorts, can reel off what he calls the headwinds coming at the giant, among them increasingly nutrition-conscious Americans who might not be tempted by Big Macs and their roughly 28 grams of fat.

Easterbook’s introduction of all-day Egg McMuffins in October at most domestic locations helped yank the company out of its recent funk. There was a 5.7 percent boostin fourth-quarter sales at established U.S. restaurants, the biggest gain since 2012. Global profit climbed 10 percent. The stock is trading at a 38 percent premium to the Standard & Poor’s 500 Index on a price-to-earnings basis, a nice switch from the 3.2 percent discount early last year.

The CEO has made tweaks big and small since he took the helm of the world’s largest restaurant chain in March 2015. He slimmed down the corporate staff, revamped drive-thru ordering to make it more efficient and tackled the flabby hamburger-bun issue by requiring they be toasted longer. Some stores are experimenting with touch-screen menus. The goal is to stem, then reverse, the slide in traffic. Guest counts, as they’re called in the business, have been falling for three years, dropping 3 percent in the U.S. in 2015.

The challenge will be to sustain the breakfast buzz long enough for Easterbrook’s team to address all the nagging issues and follow through on innovations like the create-your-own-burger endeavor. “They want to keep that going over a consistent, long period,” said Jack Russo, an analyst at Edward Jones. “There’s no easy fix on that.”

For some customers, the novelty of hashbrowns at 1 p.m. will wear off. And competitors are elbowing in, with Dunkin’ Donuts, for example, overhauling its menu boards to emphasize its all-day breakfast fare. McDonald’s is aiming to keep up the pace with new items; restaurants in the south will soon be offering McGriddles breakfast sandwiches at all hours. Round-the-clock hotcakes and Egg McMuffins debuted in Australia a few months ago and may show up in other countries, according to McDonald’s spokeswoman Becca Hary.

Even if the breakfast glow fades, the company is hardly in danger of a meltdown, no matter some analysts’ worries. (More of them have sell or hold recommendations out on the stock than buy ratings, an unusual ratio for a company that’s posted such outsize returns.) McDonald’s continues to add restaurants. The dividend keeps growing, with data compiled by Bloomberg showing a 4.8 percent uptick over the past year. And the stock rose 26 percent in 2015, outpacing gains at Yum! Brands Inc. and Wendy’s Co. “People are flocking to safety,” Goldin said. “It’s looked at as kind of a low-risk investment.”

Of course, to stay that way, it’ll have to draw more customers. “The trick is to find right price and the right products that stimulate enough traffic and sales and doesn’t hurt you too badly” if some diners trade down to cheap items, said David Palmer, an analyst at RBC Capital Markets. Now’s the time to get that right because “the company has reestablished some momentum.”

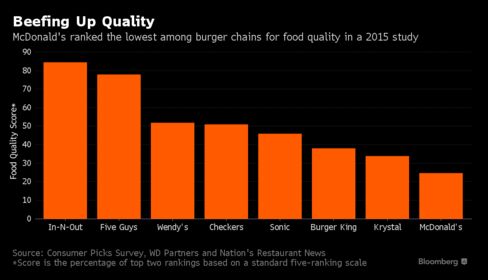

McDonald’s knows it needs to appeal to Americans’ appetite for healthier, environmentally friendly fare. The chain also has a less than stellar reputation in its limited-service burger-chain universe: It scored lowest in quality, trailing Wendy’s, Burger King and Jack in the Box Inc., in a 2015 consumer survey by WD Partners and Nation’s Restaurant News.

The company has committed to cleaner ingredients, though change will be slow because of its massive size: 36,500 restaurants in more than 100 countries. Serving onlycage-free eggs at U.S. and Canadian stores will take a decade, while putting only chicken raised without certain antibiotics on the menu will take two years.

“Their biggest challenge is really being able to resonate with the consumer on fresh and quality, and all the things that the millennials want,” said BTIG analyst Peter Saleh.

Labor costs are a thornier issue. McDonald’s has been feeling some pay-cost pain in the U.S. The profit margin at U.S. restaurants narrowed to 15.1 percent last year, from 17.4 percent in 2014, and the company cited higher wage and benefit expenses.

At the beginning of this year, 14 states raised their minimum rates, and lawmakers in California just made a deal to hike the most populous state’s hourly minimum to $15 by 2022. McDonald’s increased pay by $1 for employees of its 1,400 corporate-owned locations last year, putting pressure on franchisees to follow.

“Labor costs are going to rise and they’re either going to have to suck it up or pass it along,” Goldin said, “and my sense is they’ll do a little bit of both.”

【日本通信】日本麥當勞大幅衰退 美國讓出經營權

口頭管理評論巨型企業很容易。我很驚訝日本的麥當勞在有點民族主義的嫌棄(中國供應商的食安疑慮)下,一路走下坡,畢業日本老化問題不是現在才開始。

不進則退的快餐老大麥當勞 (馬克·比特曼); 日本麥當勞衰落的原因(野嶋 剛)

by

台灣頂新一審獲判無罪,民眾發動「滅頂行動」,透過拒買、秒買秒退等手段,呼籲政府重視食品安全。究竟小蝦米有沒有辦法扳倒大鯨魚?近兩年日本麥當勞的衰退,似乎是「消費改變世界」的最好證明。

90年代低價戰奏效 市佔率全日本第一

根據日本經濟新聞報導,日本麥當勞最大股東美國麥當勞打算賣出約33%的股票,已經和日本國內企業、國內外投資基金接觸,尋找可能買主。45年來,由美國總公司主導的經營即將畫下句點。

1994年,麥當勞開始打價格戰,當時一個210圓的漢堡以不到半價的100圓提供,於九月中實施了十七天的特賣,結果販賣數量是前年同期的18倍,2750萬個。營業額比前一年同期增長了五倍。

此後,低價格成為麥當勞的戰略。根據統計當年麥當勞的來客數高達13億人,平均一個日本人造訪麥當勞十次,同年還新增加了399家新店,,至2001年為止,佔了日本速食市場的68.1%。

讓麥當勞成為市佔率第一名的族群,多半是以十幾二十歲年輕人為主,但近年日本速食市場有縮小趨勢,但麥當勞的衰退特別顯著,這兩年業績慘淡,2014年出現掛牌交易以來首度負成長,虧損達218億日圓。

麥當勞近五年營收,2014年首度赤字

麥當勞近五年營收,2014年首度赤字連續兩年營收負成長、美國麥當勞讓出經營主導

2015年一至九月虧損292億日圓,與去年同期相比營收下跌了20.2%,來客數減少14.9%。關鍵是去年的「上海過期雞肉事件」、以及今年初一連串的異物混入事件。

2014年7月20日,上海喜福食品使用過期半年、已變色的雞肉製造麥克雞塊、工人徒手觸摸肉品、將掉到地板上的雞肉撿回生產線的映像在日本放映,立刻引起了軒然大波。隔天麥當勞緊急終止販售麥克雞塊,並宣布改用泰國雞肉,但仍挽不回消費者信心,來客數八月減少16.9%、九月減少15.6%,即便贈送雞塊免費兌換券,仍有許多人表示「送我吃也不要」。

今年初消費者透過SNS控訴在麥當勞餐點中吃到牙齒、螺絲、塑膠片等異物,加上日媒大篇幅報導,又在麥當勞尚未結痂的傷口上捅了一刀,緊急召開記者會向消費者謝罪。然而麥當勞等於「不安全」、「不潔」的印象深植人心,光是一月的來客數就少了近三成,營業額劇減38.6%。

不受女性與家長青睞、年輕世代印象分數差

台灣「滅頂行動」透過拒買、秒買秒退的手段全台串聯,日本這種情況少見,更多人是「不知怎麼就不會想去」,但這種「盡在不言中」的風氣卻發揮了莫大影響力。

根據「living生活HOW研究所」網站於今年三月針對全國女性消費者(有效份數647份、平均年齡44歲)所做的問卷調查,經過上述一連串事件後,「對麥當勞印象變差」的比例高達97.7%,僅2.3%表示不在意;30.9%表示「再也不去麥當勞」、26.3%「偶爾去」,回答「仍照常去」的人僅佔了9.4%。甚至有人表示「若有人邀我去麥當勞,我會拒絕」。

女性一向被認為對潮流敏感,得此結果並不意外,但日經business的問卷調查(有效份數1165份,男女各半)則得出意外的結論:一向被認為對健康較不在乎、有可能因經濟因素而選擇麥當勞的二十世代,竟然對麥當勞印象最差,在「CP值」、「健康面」、「安全性」、「品牌形象」等項目中,回答「印象差」或「有點差」的比例,都高過了全體平均,甚至有七成的二十世代認為「麥當勞對健康有不良影響」。對鎖定年輕人為消費主力的麥當勞來說,無疑是天大的壞消息。

問卷還顯示有超過六成的家長已經「減少利用麥當勞」。縱然麥當勞今年推出「Mother’s Eye」專案,邀請媽媽們一同巡視分店、工廠,開發菜單,執行長卡莎諾娃(Sarah Casanova)更走遍47都道府縣傾聽媽媽們的意見,但想扭轉印象仍需時間。

與之相比,去年八月日本肯德基當機立斷的宣布全面改用國產雞肉,此舉博得了消費者的好感,不僅2014年營業額止跌回升,增加了2.9%,今年持續看漲,截至11月為止,平均營業額增加8.7%,來客數增加1.2%。

英澳麥當勞改革、業績成長

許多國家的麥當勞紛紛展開更符合國情的改革。現在到英國麥當勞點份薯條,鹽分只有2003年時的四分之一,甚至還提供無鹽版本。包含牛肉、馬鈴薯、雞蛋,55%的食材為英國產;澳洲麥當勞則導入觸碰式螢幕,顧客可以自由選擇喜歡的麵包、蔬菜,製作獨一無二的漢堡。今年一到九月,兩國營業額分別成長了5.2%與7.1%。

日本麥當勞將如何改頭換面、正視消費者注重健康與產地的風潮,挽回消費者對食安的信心,值得持續關注。

沒有留言:

張貼留言